There are always promotions being offered by credit card companies in an effort to gain new customers. A special low APR offered for a period of time or a cash back offer on certain or all purchases are the most common. The actual numbers associated with the offers are what draws the customers, however. Just how low is that APR for the next few months, or what percentage do you get as cash back on your purchases?

There are always promotions being offered by credit card companies in an effort to gain new customers. A special low APR offered for a period of time or a cash back offer on certain or all purchases are the most common. The actual numbers associated with the offers are what draws the customers, however. Just how low is that APR for the next few months, or what percentage do you get as cash back on your purchases?

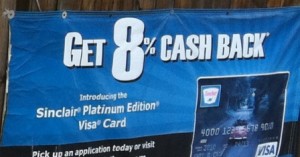

Currently, one of these offers that is receiving lots of attention is being extended by the Sinclair Visa card. This card now gives an amazing 8% cash bonus for the first two months on Sinclair purchases. Not only do you get cash back when you buy gas for your car, but you get 8% back when you stay at their hotels or even purchase a snack from them.Â

After the first two billings, the reward will be cut in half to 4% for Sinclair purchases and 1% for any other purchases. If you purchase gasoline at any other station and use your Sinclair Visa card, you will not receive any cash back reward.

Depending on your credit score, your interest rate on this card will be either 13.99%, 16.99%, or 19.99% should you carry a balance. APR can go as high as 29.99% if you don’t adhere to their terms, and this is also determined by your credit score. The Sinclair Visa card does not charge an annual fee.

Just when you think you have found the deal of all deals, you will discover that there are limitations. The Sinclair Visa 8% offer is a really good one, and the 4% offered after the first two months is still better than most cards offer. If you choose this card, though, you will stop receiving the 4% cash back when you have spent $7500. The 4% will decrease to only 1%, and your reward points will run out each year. However, there is no limit as to how many points you can accumulate each year, and you will get $25 for each 2500 points. Except for cash, this will be paid to you in a method you choose.

In dealing with Sinclair, you can feel confident that you have chosen to do business with a reputable company. Sinclair has been around since 1916 and is now among the largest oil companies in the United States. Besides the oil business, Sinclair has also entered into other types of business ventures.

The biggest obstacle affecting the Sinclair Visa 8% offer is that it won’t do you a lot of good unless you live in a state where Sinclair stations are located. There are only 21 states where they exist, so accessibility is limited. If you are in an area where you can benefit from using this card, though, you can easily apply for it online, or you can stop by your local Sinclair service station and pick up an application form. Just fill in your information and either click to submit or drop it in the mail. You are also given the option of designing your own card. Before filling out the application, however, you will be asked to confirm that you always pay your bills on time and that you have no bankruptcies in your credit history.